The word Millennials generates many reactions. From excitement to see in this generation great opportunities to bewilderment for not knowing how to generate these opportunities. In financial services many times the reaction caused by Millennials is the second one. This generation is of great importance, given that it is the largest one in terms of the amount of people and by 2025 it will represent 75% of the global labor force. Moreover, it is estimated that 2020 will be their decade of larger spending.

Millennials and Xers (35 to 51 years old) have very similar expectations and usage patterns. Both tend to be far more prone to use regional banks as their main banking provider. These generations share (in the same order) the 5 most popular attributes that they look for in their banking institution, from security to simplicity, transparency, Omni channel options, capacity to predict and satisfy their financial needs. Both groups manage 75% of their banking interactions through online channels and perform twice as many transactions from mobile phones as Baby Boomers.

3 out 4

Banking interactions through digital channels

x2

Mobile banking interactions than Baby Boomers

According to the study ‘PACE FIS 2017’ there is a great contrast between the de percentage of Millennials customers in community banks and traditional big banks. In traditional big banks, there are more than twice as many Millennials per 100 customers (42%) than in community banks (18%).This gap is only getting bigger. Big traditional banks innovations and investments in improving their digital experiences, together with Millennials.

Millennials have on average the highest amount of transactions with their banks Millennials Gen X Baby Boomers having the highest average of monthly interactions with their banks, based on increasingly mobile use and ATMs. In fact, mobile banking activity has surpassed web banking among Millennials.

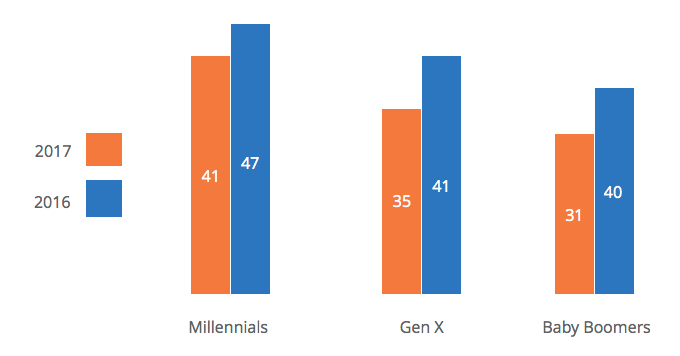

Increase of banking interactions across all channels(%)

Thanks to the accessibility through digital channels, banking interactions are increasing in all demographics segments. Community banks and Credit and Savings unions should enhance their digital experience.

Nevertheless, the popularity of this payment method may vary depending on the segment. Young Millennials are twice as likely to make P2P mobile payments than older Millennials and x10 more likely than Gen Xers.

Looking towards the near future, the tendency would probably mark a mobile payments’ (as mobile wallets and Peer to peer solutions) demand increase. However, the FIS investigation says that for now, community banks run behind big traditional banks in the mobile payments race. Will they be able to catch up?

Bankingly helps financial institutions to not only serve but to conquer the millennials with our platform of digital channels. Download the presentation and learn how it works: